Nicholas Levenstein & Company

We produce quarterly

income for our clients.

Nicholas Levenstein & Company (NLC) has been managing a successful hedge fund for over five years, delivering exceptional, risk-managed returns. We realize profits by quarter-end, minimize downside risk, and offer investors liquidity without a lock-up period.

Schedule a Meeting

Q2 2025 Report:

CMFDH II delivered a Q2 2025 net return of 12.95%, driven by active derivatives strategies that prioritized dollar-based performance. Year-to-date performance stands at 3.17%. Success fees this quarter were applied only to gains above the high watermark set on December 31, 2024.

We remain committed to transparency and continuous improvement, with current goals including capital growth, trade execution, and investor outreach. View our OKRs.

Nicholas Levenstein & Company

We produce quarterly

income for our clients.

Nicholas Levenstein & Company (NLC) has been managing a successful hedge fund for over five years, delivering exceptional, risk-managed returns. We realize profits by quarter-end, minimize downside risk, and offer investors liquidity without a lock-up period.

View Quarterly Report

Q3 2025 Report: Crypto Money Fund Dollar Hedge II

IRR: 61% | Sharpe Ratio: 1.5

Quarterly Return: 6.08% gross ($77,669) — 4.56% net ($58,252) after fees.

The fund closed Q3 2025 with solid results, continuing its strong multi-year trend. Amid tightening spreads as major Wall Street players enter the crypto derivatives market, our strategy evolved from selling overpriced options to using AI-driven deep analysis tools. These provide superior performance over prior automated algorithms and allow dynamic, adaptive position management.

Our long-term commitment remains unchanged. In 2022, we returned investor capital even with a 13% gain, upholding our high standards (Bitcoin fell 66% that year). In 2023, we delivered over 100% returns, proving our resilience. Our positions remain fully collateralized — meaning zero liquidation risk — offering investors unmatched stability in a volatile market.

Looking ahead, we maintain a focus on steady growth while being prepared to capitalize on any market dislocation similar to 2022’s event, where our structure allowed superior performance. The fund’s balance of discipline and flexibility keeps us positioned to perform even through global shifts.

Our Crypto Strategy

Invest In Crypto

With Lower Volatility

Check Our Performance

Proven Track Record

Our original fund, CMFDH, survived the 2022 market downturn when Bitcoin fell -75% with a 13% profit for the year, during which all of our CMFDH I investors’ money was returned. Our compounded annual returns over both funds were 65%.

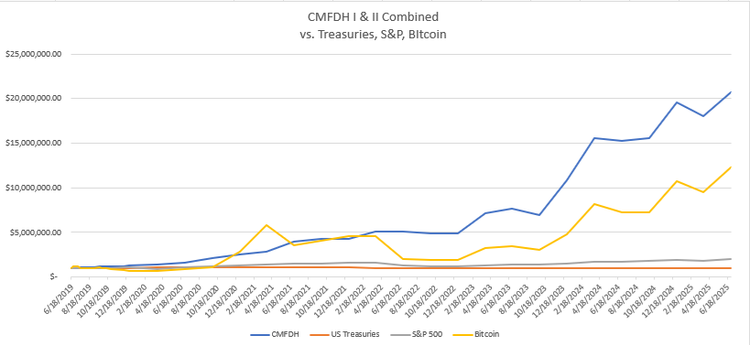

Furthermore, a formal analysis of our combined performance from 2019 to 2025 reveals an annualized Sharpe Ratio of 1.83. This key metric, which measures risk-adjusted return, places our strategy in the "Very Good" category, confirming its effectiveness at generating superior returns relative to the risk undertaken. See the full Sharpe Ratio study here.

Combined Performance Of CMFDH I And CMFDH II

Benefits of investing with us:

Diversify Your Portfolio & Earn Quarterly Income

Quarterly Returns

Our market-neutral crypto strategy delivers reliable income generation regardless of market conditions.

Downside Protection

Our hedging techniques preserved capital with 13% profit in 2022 while Bitcoin fell 75%.

Audited Performance

Since 2019, investing in our consecutive funds would have yielded a 65% annual compounded return over nearly 6 years.

Market-Neutral Strategy

Sophisticated derivatives trading combining carry trades and innovative strategies for consistent profits.

Expert Team

Leadership with proven financial expertise ensures professional management of your investments.

Liquidity Access

Access your capital when needed without the restrictive lock-up periods of traditional funds.