Crypto Money Fund Dollar Hedge II (“CMFDH II”) Strategy

The CMFDH II strategy is multifaceted, focusing on a mix of carry trade, covered calls, and the newly introduced "butterfly" strategy:

Table of Contents

Carry Trade Strategy Overview

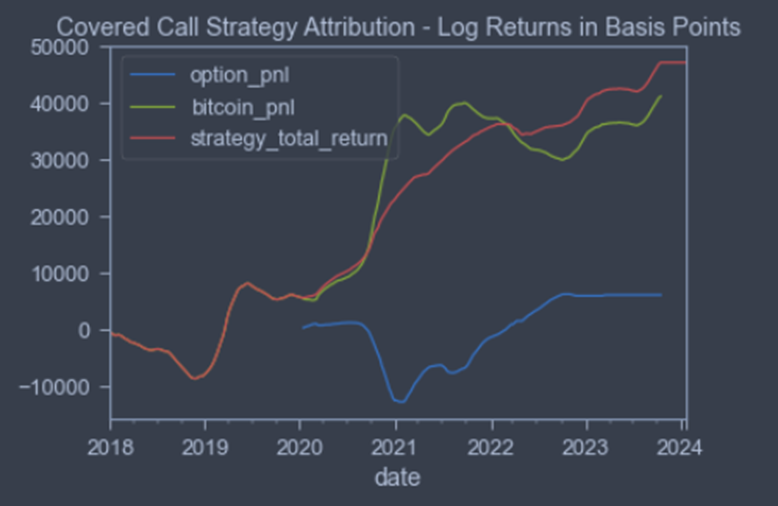

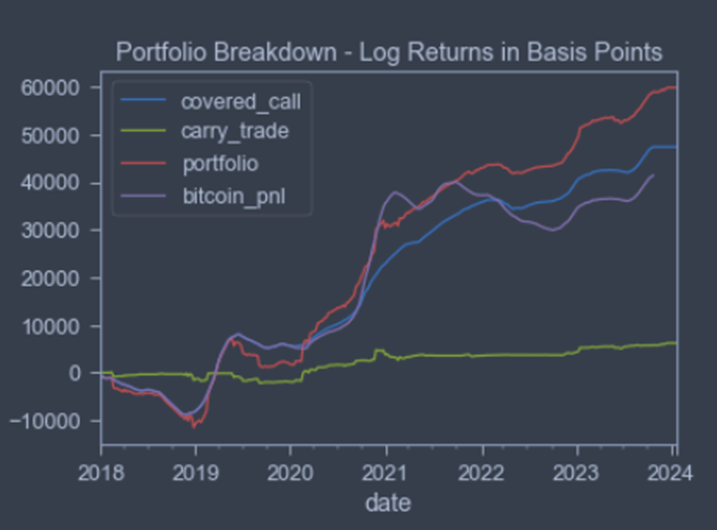

- Carry Trade and Covered Calls: The fund primarily employs the carry trade and covered call options. Two-thirds of the capital is in dollar-insured contango, ensuring dollar-defined capital preservation at the quarter's end. The carry trade, with an estimated annual volatility of 20% per unit, involves profiting from interest rate differentials between two currencies. Covered calls, with about 40% annual volatility per unit, involve holding an asset while selling call options on it, less volatile than direct Bitcoin investment (50-70% volatility). Generally, two units of carry trade are maintained to one unit of covered call, targeting a 25% annual portfolio volatility with an expected sharpe ratio of 1.5.

Call Strategy Overview

- Contango Strategy and Treasury Yields: A key component of this strategy is monitoring contango yields. If these yields approach or fall below the 90-day Treasury yields, the strategy may shift to cash or cash equivalents. This approach is part of risk management and capital preservation.

Combining Strategies for Optimal Returns

- Butterfly Strategy: The hedge fund is introducing a third strategy, the "butterfly" strategy. For more details, see Levenstein.net. We developed an automated trading program focusing on complex options and crypto derivatives, and we plan to extend its focus to other areas like listed stocks and index options. This strategy is tailored to handle unpredictable market scenarios, including "black swan" events, offering special opportunities.

Overall, the hedge fund's strategy is dynamic, blending traditional investment methods with innovative automated systems to manage risk and capitalize on market opportunities.

Market Opportunities

We are excited about our market due to several general opportunities for quarterly traders:

- Fundamentally, there is enthusiasm about the price appreciation of Bitcoin versus the US Dollar. This is reflected in our positive trades in the futures market.

- On the options side, two major opportunities greet us:

- The volatility of the asset is decreasing to a level lower than that implied in options pricing. This is beneficial for sellers like us.

- We have a program for pricing out butterflies. Soon, we will be scanning for combo trades 24/7, and sometimes they pop up! I believe the crypto derivatives market is much less competitive for such opportunities compared to traditional SEC and CFTC-regulated markets.

- Due to our specialty and focus, unusual trades occasionally arise in this emerging field, dealing with energy, hashpower, and related items.